This is my first attempt at developing a machine learning model for quantitative analysis and trading. I don't know what to expect, but I do know I will encounter a lot of challenges along the way. This model will be very simple and likely under/overfit, inaccurate, and not useful for trading.

Objective: Create a simple XGBoost model to predict weekly resistance levels for SPY.

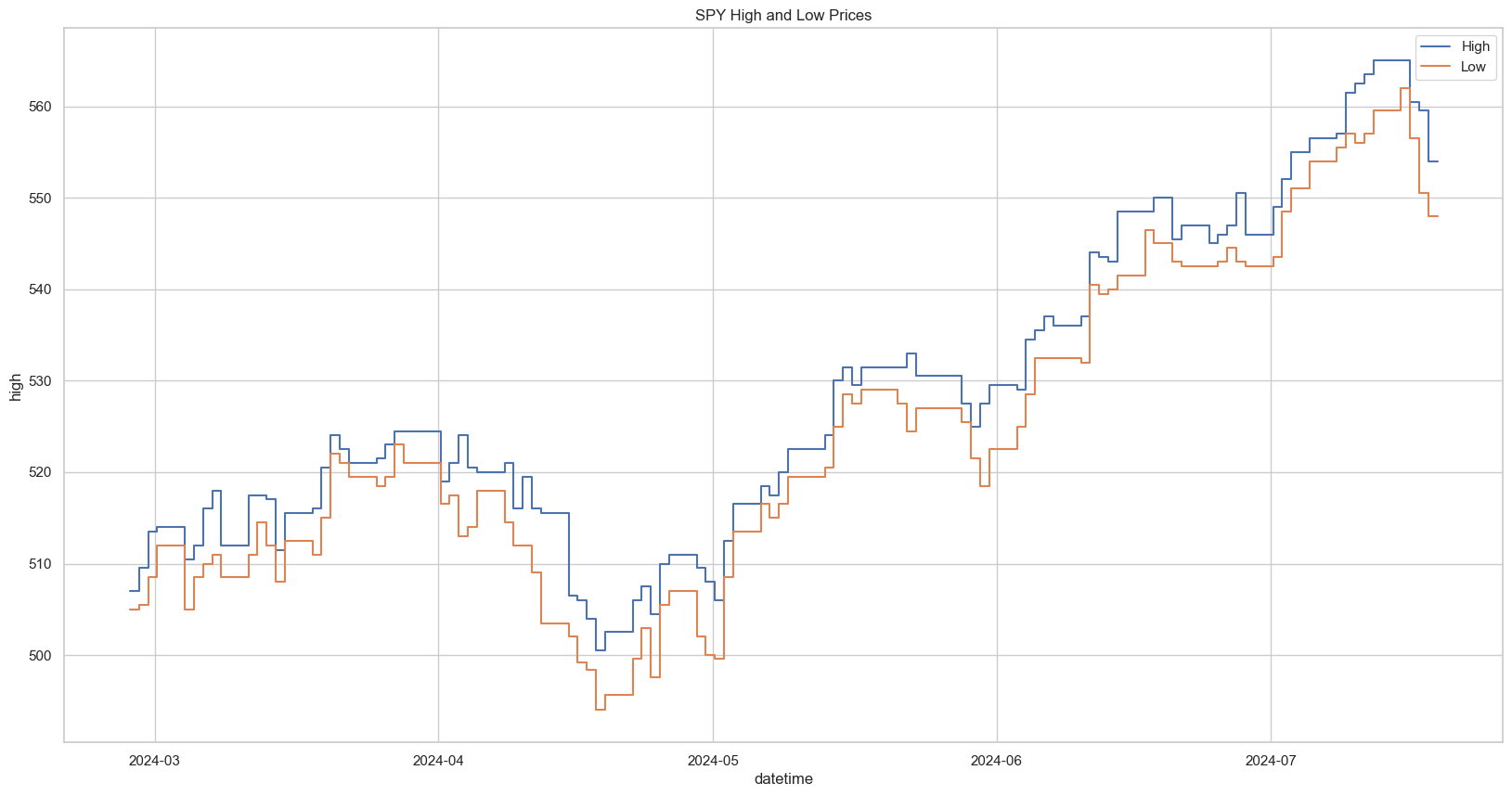

Data

- SPY daily price data (20 years)

Preprocessing the data

- Columns:

datetime,high,low - Round the

highandlowto ticks (1% of the price to 1 significant digit) - Add a column for the

dayof the week (0-4)

Preparing the dataset

- Features: array of

highandlowprices - 10 days of data (2 weeks from Monday to Friday)

- Exclude data if it doesn't have 10 days of data

- Target: next week's

highandlowprice for the week

Model

Simple XGBRegressor model with 100 estimators, 0.1 learning rate and default parameters.

Data is also scaled using StandardScaler.

I know this is very bad, but I want to start simple and then improve it.

A model is trained for the high and low prices separately.

Results

XGBoost Regressor Performance for High Data:

Train MSE: 0.3408

Test MSE: 26.6598

Train R2: 1.0000

Test R2: 0.9980XGBoost Regressor Performance for Low Data:

Train MSE: 0.2902

Test MSE: 56.1965

Train R2: 1.0000

Test R2: 0.9958Analysis

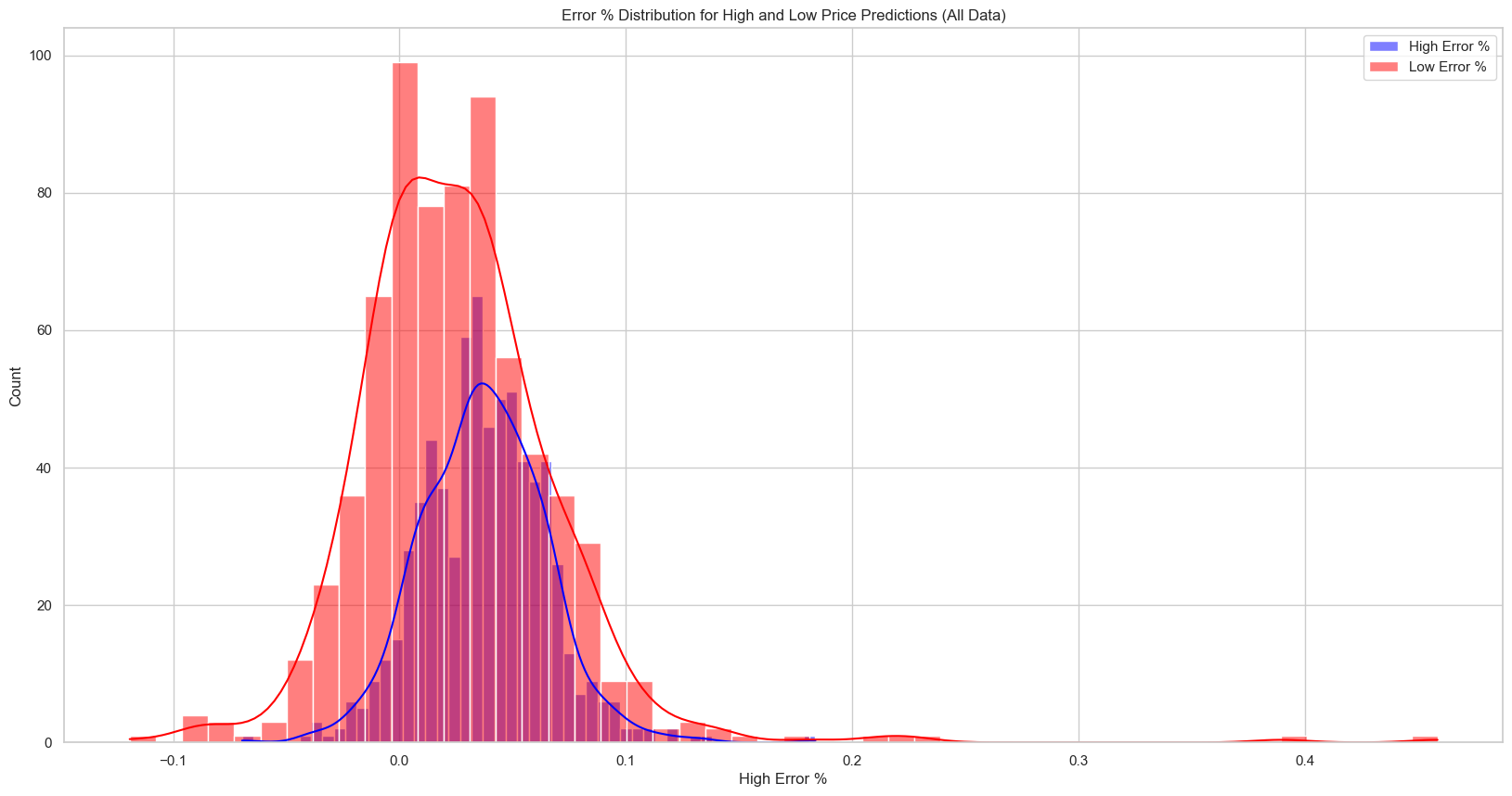

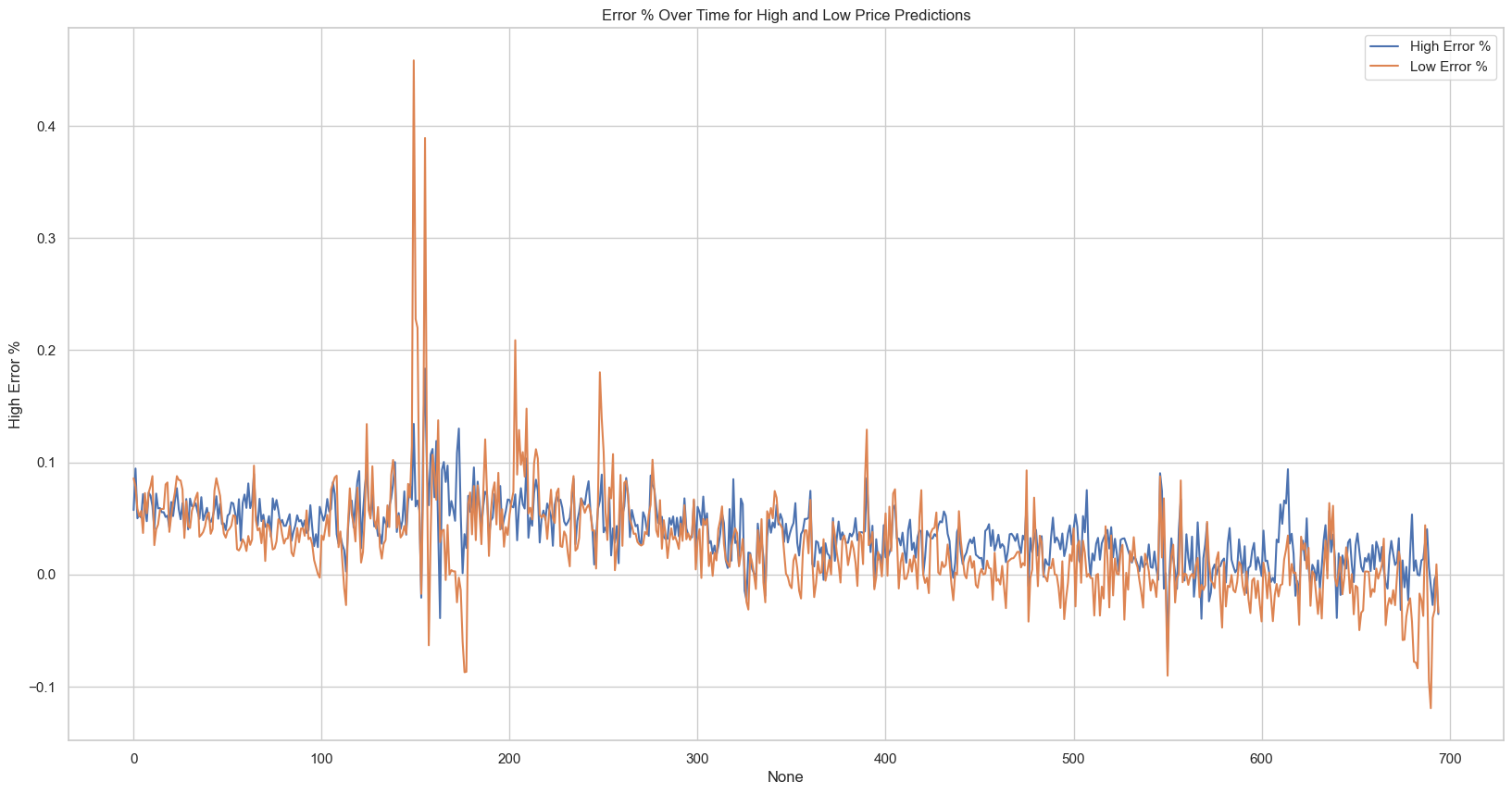

The model looks great, right? No.

for training is perfect () and test is very high ( and ) is very high too.

But, I know this is very bad. The model is likely overfitting and not generalizing well to be useful for trading.

Visualizing Error

NEXT: Training a simple weekly resistance model for SPY (Part 2)